ORGANISATIONAL STRUCTURE

Our organizational structure incorporates the principles of corporate governance, ensuring collaboration, accountability and efficiency to achieve our strategic goals.

ORGANISATIONAL STRUCTURE

Α. Basic Principles of Organizational Structure and Organizational Chart

The organisational structure of Cepal Hellas has been designed on the basis of the following basic principles:

- Alignment with the needs of the core business sector in which it operates (i.e. credit management)

- Optimal management of the professional qualifications and skills of management and employees

- Alignment with the applicable principles of the institutional framework that regulates and governs its operations

- Maintaining an adequate level of expertise

- Support cost synergies and reduce duplication

- Minimise hierarchical levels

- Strengthening of decision-making responsibility

- Well-defined, transparent and consistent lines of responsibility, as well as efficient and analytical processes in order to increase flexibility

- Clear definition of roles, responsibilities and limits of responsibility of each organisational function.

- Best principles of corporate governance

- An effective Internal Control System (ICS).

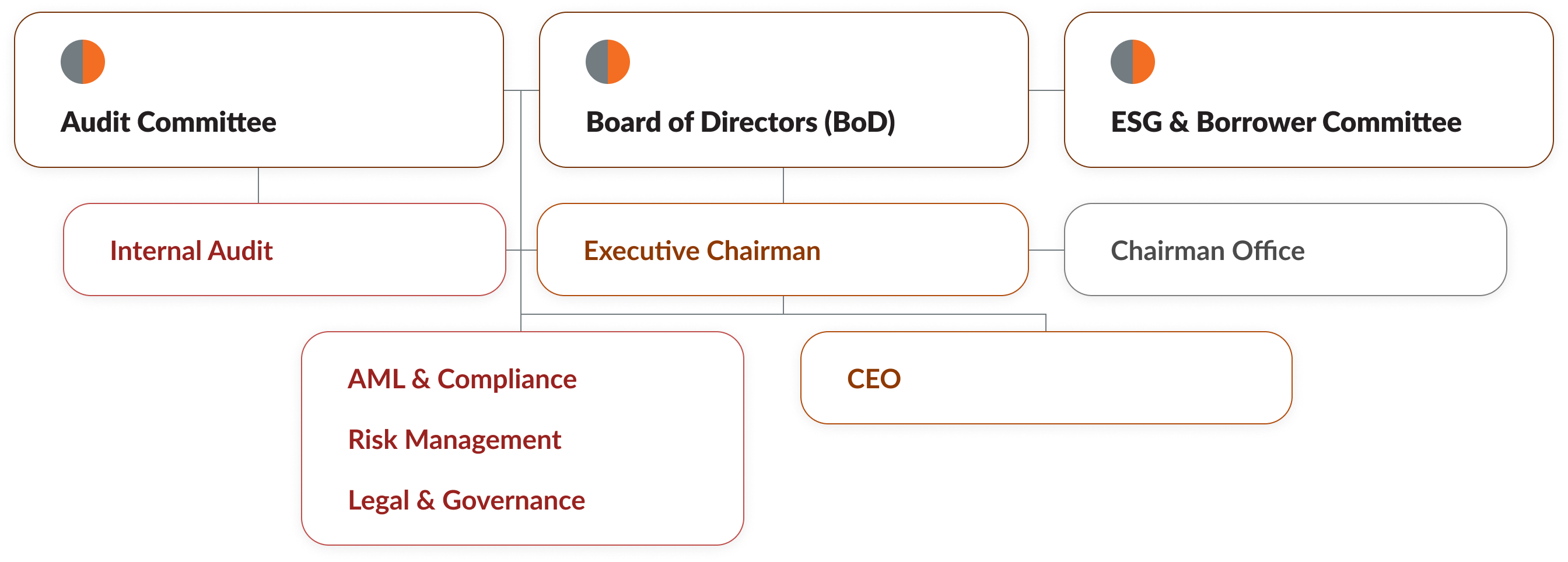

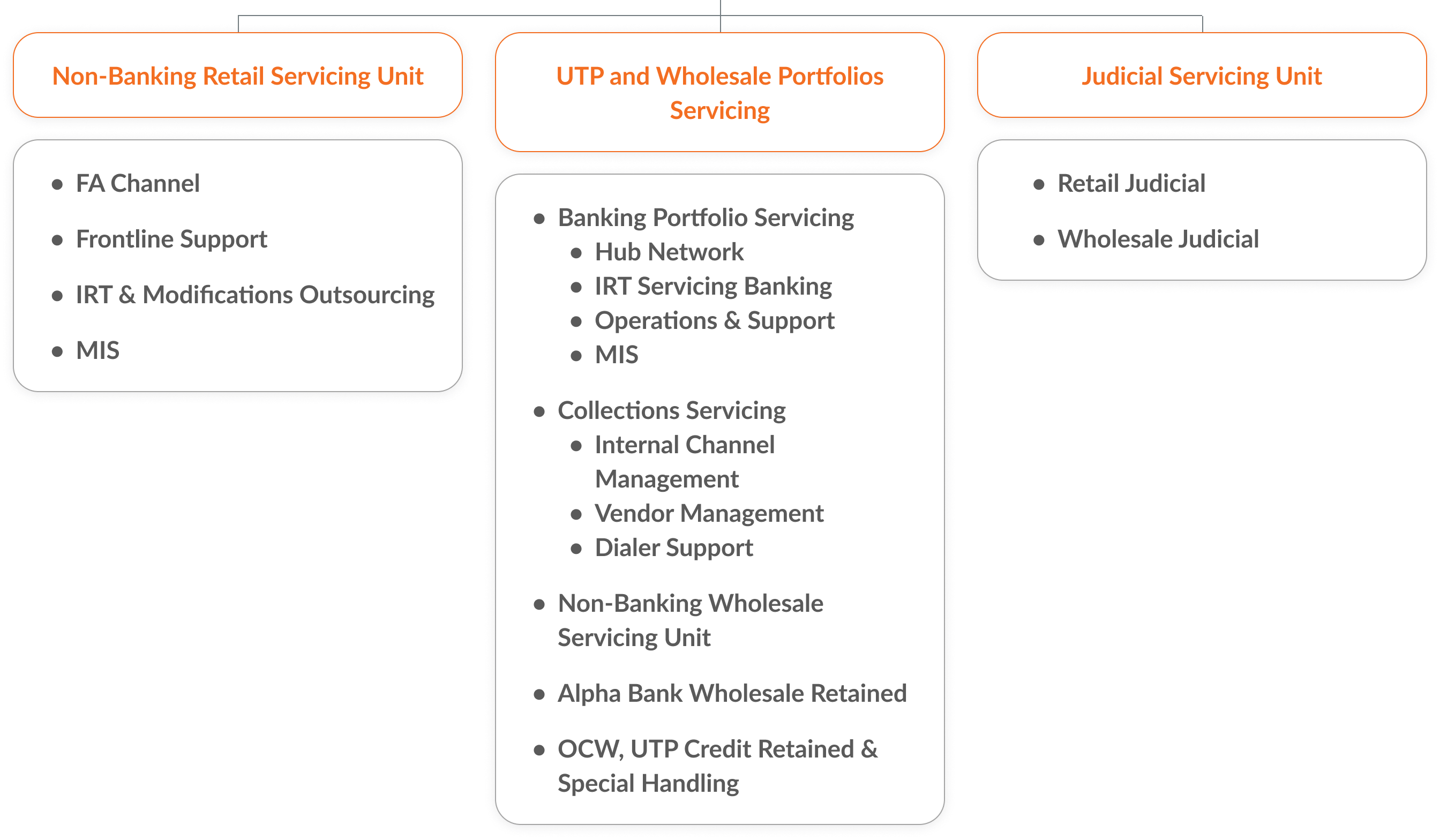

Cepal Simplified Organizational Chart

The organisational structure of Cepal is shown in the following organisation chart:

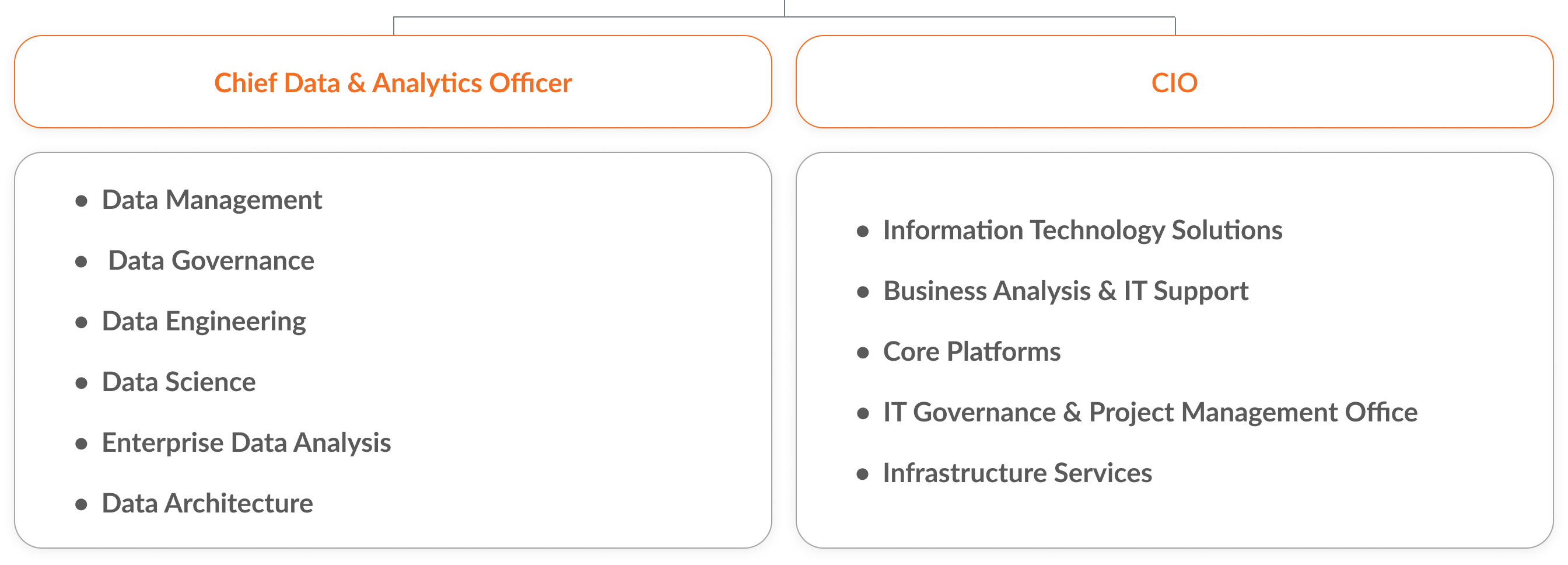

TECHNOLOGY

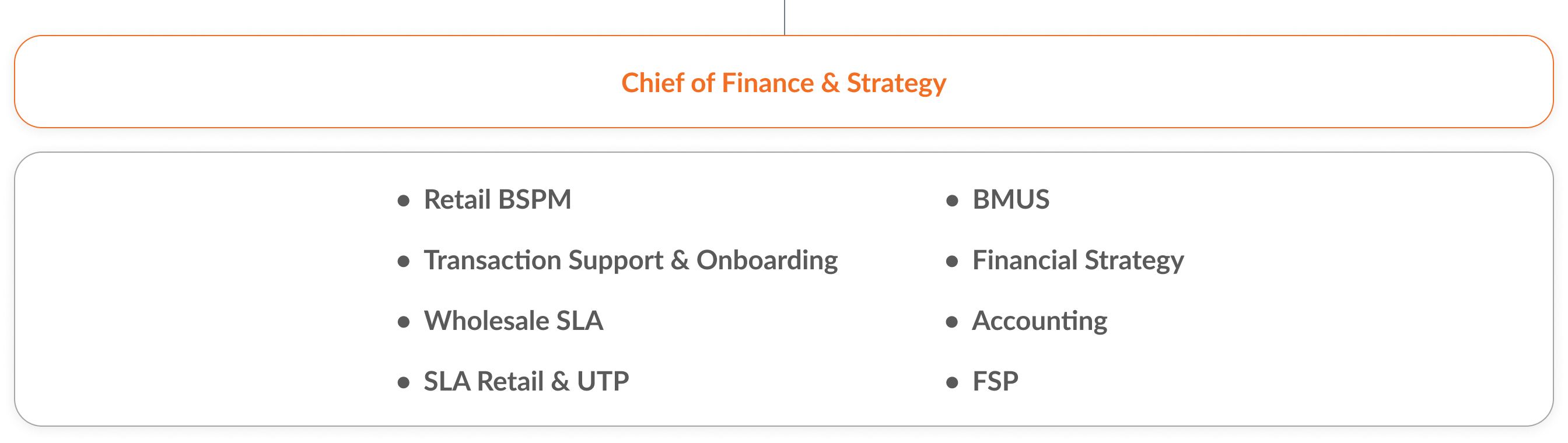

FINANCE & STRATEGY

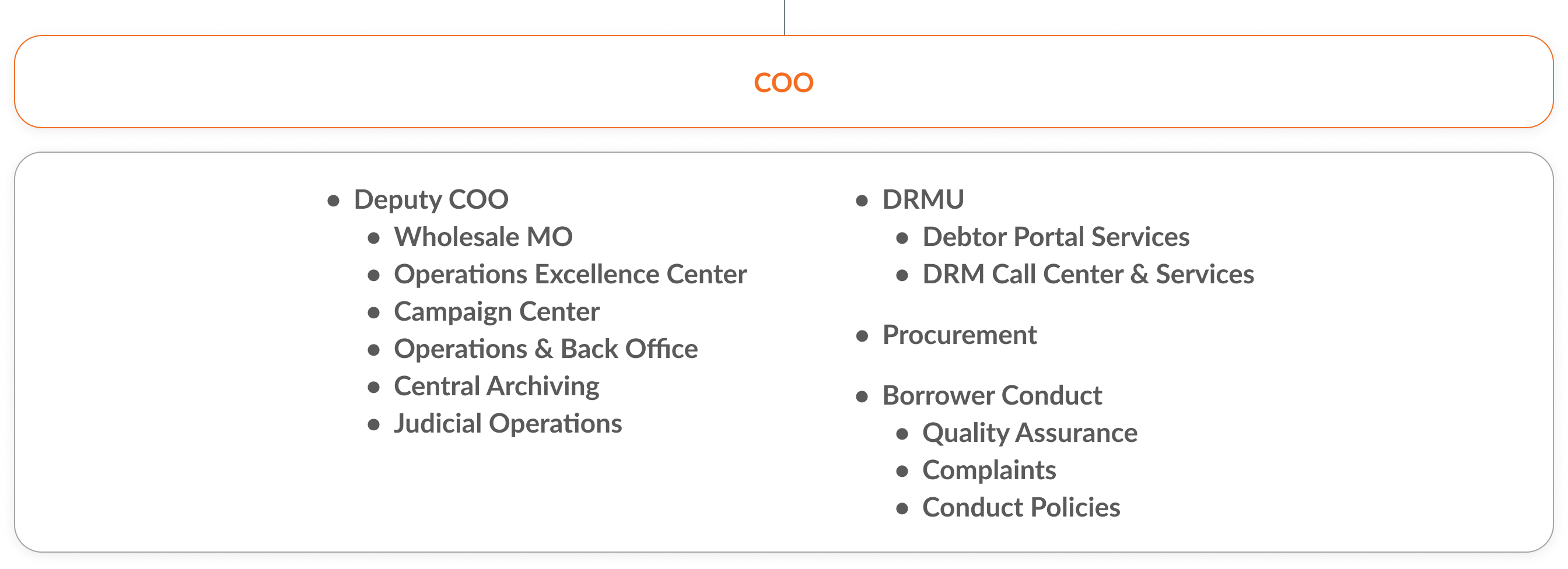

OPERATIONS

SERVICING UNITS

ORGANISATIONAL STRUCTURE

Β. Board of Directors

1. Responsibilities/Operation/Composition

The Board of Directors of Cepal Hellas exercises general direction, supervision and management of the company, maintaining a strong control framework, in accordance with the business plan, the annual budget, the provisions of the Articles of Association and the applicable legislation. In addition, it is competent to represent the Company in court and out of court and to decide on any act relating to its management, the management of its assets and, in general, the pursuit of its purpose, with the exception of matters that fall within the exclusive competence of the General Meeting, in accordance with the Articles of Association and the Company’s Internal Operating Regulations.

In the meantime, it is regularly informed of the progress made in the implementation of the ESG strategy, ensuring its alignment with our long-term commitments.

Articles of Association

In accordance with our Articles of Association, the Board of Directors meets at the Company’s headquarters whenever required. Off-site meetings (whether in Greece or abroad) are held provided that all members are present or represented at the meeting and no one objects to the holding of the meeting and the decision-making process.

According to the provisions of Law 4548/2018 and the Articles of Association of the company, Cepal Hellas is managed by a Board of Directors consisting of 3 to 9 members, who are elected by the General Assembly, which determines the term of office.

Structure of the Board of Directors

Based on the decision of the General Meeting of the sole shareholder of Cepal Hellas of 19.07.2024, it was decided to elect a new five-member Board of Directors of the Company with a three-year term of office until 19 July 2027. In addition, based on the resolution of the Board of Directors of Cepal Hellas of 19.07.2024, it was decided to form the Board as follows:

- Artemios Theodorides, Executive Chairman

- Theodoros Athanasopoulos, Managing Director

- Plutarchos Sakellaris, Independent Non-Executive Member.

- Kenneth John Stannard, Non-Executive Member

- Miriam Ceribelli, Non-Executive Member

2. Practical Evaluation of the Suitability of the Members of the Board of Directors and the Heads of Critical Functions

Within the framework of the Assessment of the Suitability of the members of the Board of Directors and heads of critical functions, carried out in accordance with Article 6 par. 1 of the Law 5072/2023 and the provisions of the Act of the Executive Committee (AEC) 225/30.01.2024, the members of the Board of Directors and the heads of critical functions shall complete the Questionnaire for the assessment of the suitability of members of the Board of Directors and the heads of critical functions of less important institutions of Annex II of the AEC 224/21.12. 2023, through which their compliance with the existing regulatory framework and the fulfilment of the suitability criteria are confirmed, and information on personal relationships both for the person being assessed and for his/her close relatives or legal entities in which he/she has a specific interest, which may constitute cases of conflict of interest, is declared.

ORGANISATIONAL STRUCTURE

C. Committees

1. Committees of the Board of Directors of the Shareholder

The Board of Directors of Cepal Services & Shareholdings SA has established the following specialized committees with specific responsibilities, which contribute to the effective supervision of the Company:

The Strategic Planning Committee

Consists of at least three (3) members, who are non-executive members of the Shareholder’s Board of Directors and/or non-executive members of the Board of Directors of Cepal Hellas and are appointed by decision of the Board of Directors of Cepal Services & Holdings. The responsibilities of the Strategic Planning Committee include the periodic monitoring of the implementation of the Group’s and the Company’s strategic plan and the submission to the respective Boards of Directors of proposals for new projects, changes, improvements and corrective actions thereon. The Committee is convened and meets at least quarterly, with the possibility of special meetings as required by the needs.

The Remuneration Committee

Consists of at least three (3) members, who are non-executive members of the Board of Directors of Cepal Services & Holdings and/or Cepal Hellas, appointed by resolution of the Board of Directors of Cepal Services & Holdings. The Remuneration Committee deals, among other matters, with remuneration issues for the members of the Board of Directors of the Group companies, as well as for the members of the Management and the staff in general, being responsible for the formulation and implementation of the Company’s Remuneration Policy, as approved by the Board of Directors. The Committee is convened and meets at least quarterly, with the possibility of extraordinary meetings as required by the needs.

2. Committees of the Board of Directors of the Company

The Board of Directors is assisted in its work by Committees to which it may delegate responsibilities, clearly defining their tasks, composition and operating procedures, ensuring in any case its internal coherence, complementarity and the necessary coordination. The Committees of the Board of Directors of Cepal Hellas are the Audit Committee and the ESG & Borrowers Committee.

Audit Committee

The Audit Committee supports the Board of Directors in the execution of its supervisory responsibilities in order to ensure compliance with the legal and regulatory framework with regard to the following:

- Financial reporting process

- Tactical audit

- Internal Control System.

The Committee shall consist of at least three (3) members. The exact number of Committee Members shall be determined by the Board of Directors of the Company. All Committee Members shall be non-executive members of the Board of Directors and at least one (1) of them shall be Independent. The Chairman of the Board of Directors may not be member of the Committee. The Chairman of the Committee is an Independent non-executive member of the Board of Directors who has not held an executive role in the Company in the 12 months preceding his appointment and has the necessary expertise and experience to monitor the audit, accounting and financial policies and procedures within the scope of the Committee’s responsibilities. The nature and composition of the Committee and the term of office, number and responsibilities of its members shall be determined by the Board of Directors.

The Audit Committee shall meet regularly on a quarterly basis, adding meetings based on its needs.

ESG and Borrowers Committee

The ESG and Borrowers Committee shall have, amongst others, the following responsibilities:

- Monitoring, evaluating and reviewing policies related to Environmental Social & Governance (ESG) issues

- Identifying and assessing potential ESG-related risks and opportunities and submitting ESG-related issues to the Board of Directors for approval where required

- Reviewing on a regular basis the issues addressed by the Borrowers’ Committee, monitoring on issues requiring action by the Company as deemed necessary, and reporting to the Board of Directors on the outcome of actions taken by the Borrowers’ Committee, explaining how these actions contribute to the implementation and improvement of the Company’s strategy in relation to ESG issues.

The ESG & Borrowers Committee consists of at least three (3) members, who are members of the Board of Directors, of which at least one (1) is a non-executive member of the Board of Directors. The following members of the Management participate in the Committee as non-voting members: 1) the Chief Human Resources & Communications Officer and 2) the Chief Operations Officer. The nature and composition of the Committee and the term of office, number and responsibilities of its members are determined by the Board of Directors of the Company.

The Committee shall convene and meet at least quarterly, with the possibility of extraordinary meetings as required by the needs.

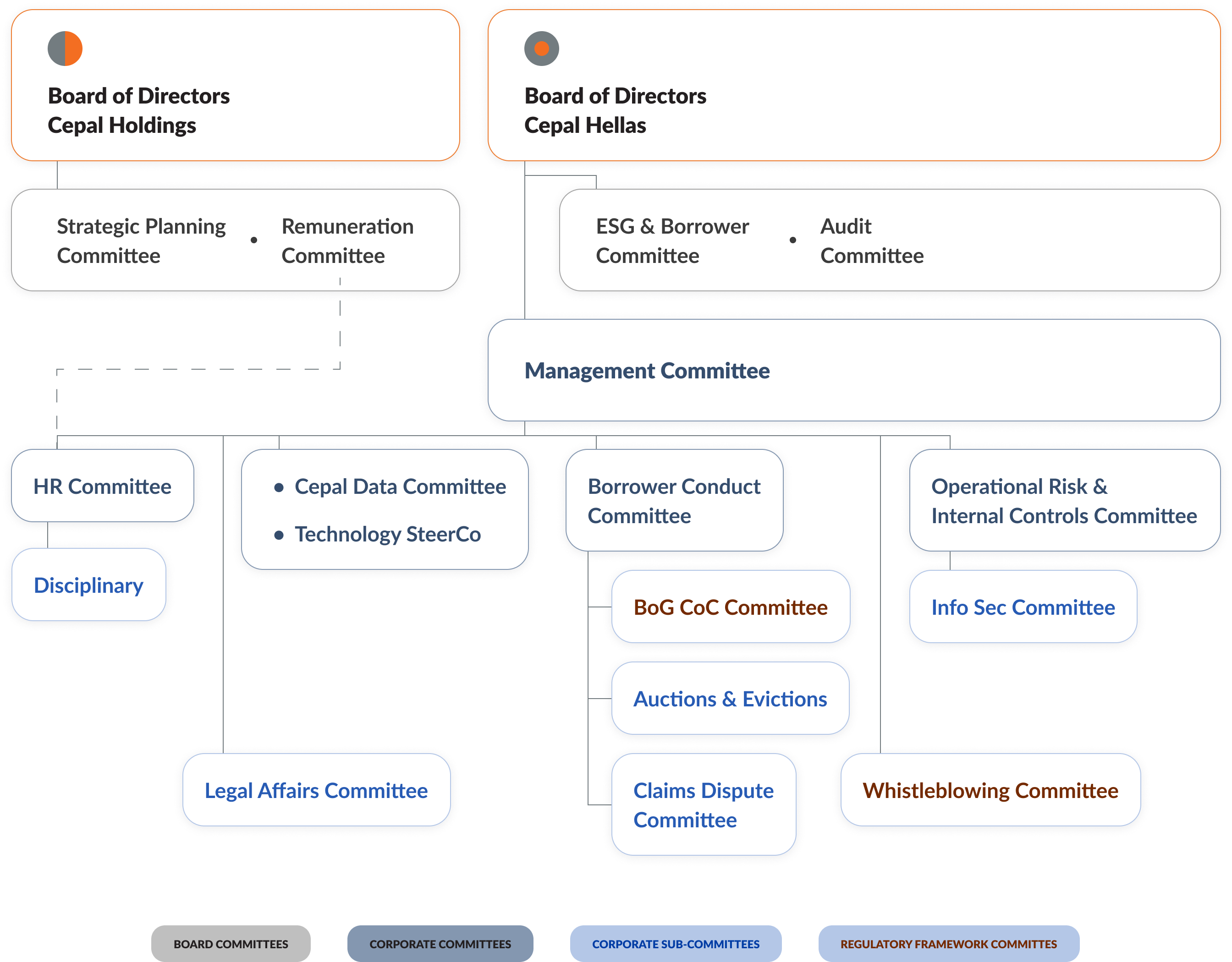

3. Corporate Committees, Supervisory Framework Committees and Portfolio Management Committees

In order to address the complexity of the Company’s operations within its organisational structure, in addition to the above Board of Directors Committees, the Company has established Corporate Committees and Sub-Committees, Supervisory Framework Committees and Portfolio Management Committees and Sub-Committees, to which it may delegate responsibilities relating to its business activities, compliance with the applicable legal and regulatory framework and credit portfolio management, respectively.

In total, the Committees operating in the Company and their reporting structure are reflected in the following table:

Corporate Committees Structure

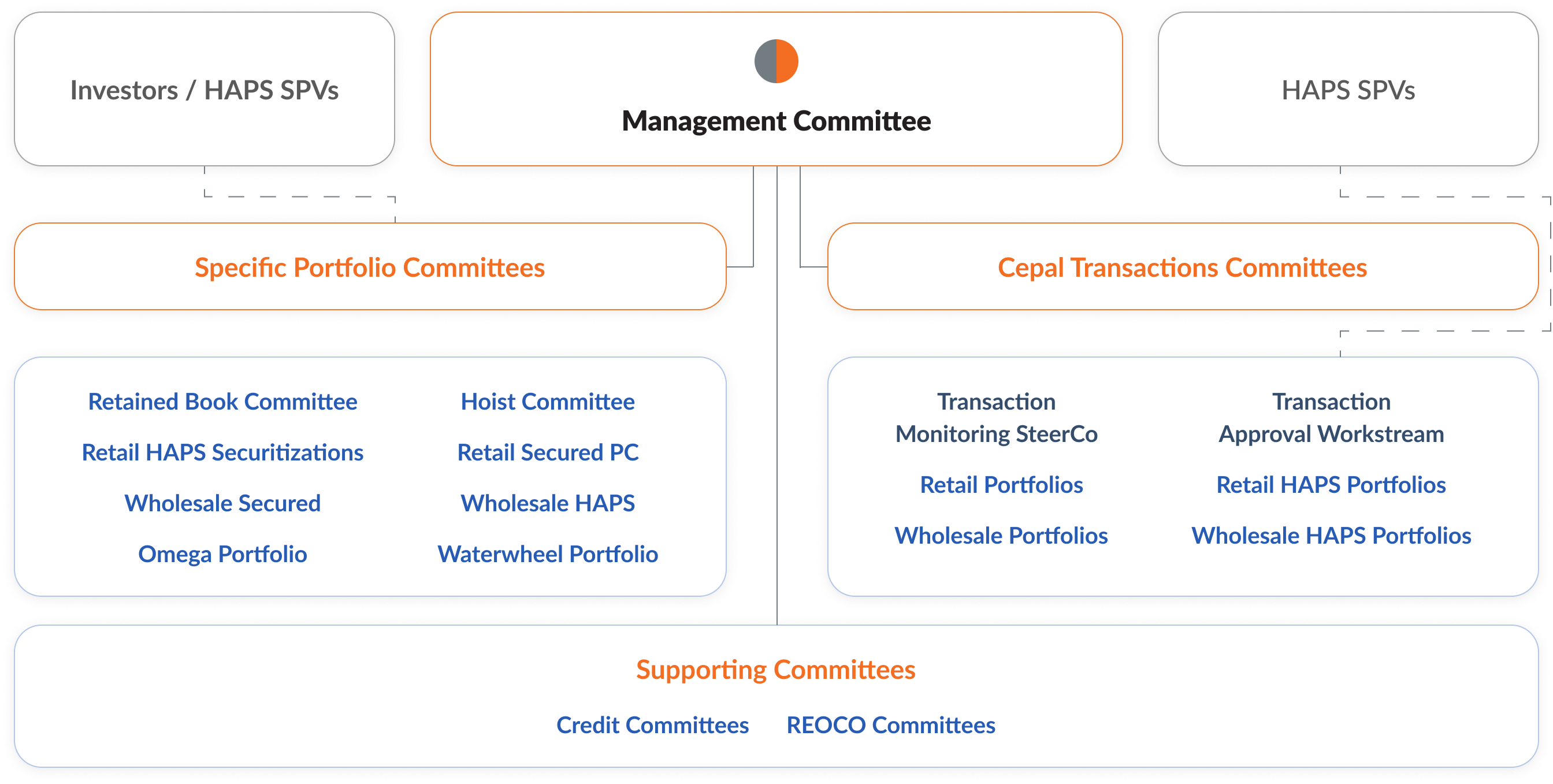

Cepal Hellas Portfolio /

Asset Management Committees Structure

Each Committee operates under its respective Charter and the members of each Committee are appointed by an Act of the Chief Executive Officer.